All Categories

Featured

The buildings are redeemed at the time of a bankruptcy sale. Rate of interest is just paid when a tax lien is redeemed. There are no various other rate of interest payments. 1099 records are filed with the internal revenue service yearly on redeemed properties. Home ends up being tax-defaulted land if the residential property taxes continue to be unpaid at 12:01 a.m. on July 1st.

Home that has ended up being tax-defaulted after five years( or three years in the case of residential property that is likewise subject to a problem abatement lien)comes to be subject to the region tax collector's power to sell in order to satisfy the defaulted residential property taxes. You're wondering concerning getting tax obligation liens in Texas? Acquiring tax obligation liens in Texas isn't ideal for brand-new investors since it's a complicated process that might cost you quite a bit if you aren't mindful.

How To Tax Lien Investing

Keep in mind: The redemption period is normally 180 days, however it can be as long as two years if the residential or commercial property is a property homestead or land designated for agricultural use. The majority of territories need you to pay real estate tax by January 31. You are overdue if the tax obligations have not been paid by February 1st. When a residential property has a tax obligation

lien certification put against it, the certificate will be auctioned off to the highest possible prospective buyer. The public auctions can take area online or face to face. As a capitalist, you earn money when the homeowner pays back the tax obligation financial debt plus passion. If the property owner does not pay the financial debt within a sensible time structure(the.

Buying Tax Liens For Investment

specific time structure will certainly vary relying on the tiring authority and neighborhood market ), the lienholder can foreclose on the residential or commercial property - investing tax lien. One more benefit of investing in tax liens is that you can conveniently calculate the price of return. Since you're paid a lump sum when the lien fixes, you 'll have the ability to determine just how much you're getting and your price of return. There's a great deal to be acquired when spending in tax obligation liens, the threats should not be glossed over. This can be problematic due to the fact that it will certainly call for even more cash than originally anticipated. An additional risk is that the home you're bidding on might be in inadequate problem, the home might have endured environmental damage, or chemicals, or unsafe products might contaminate the property. Then, there's the problem of revenue. Unlike buying rental homes that generate a month-to-month income, your earnings is one round figure. In the weird opportunity that the homeowner does not redeem their home, you'll need to identify what you'll make with the building after the foreclosure wraps up. What can you do? Well, you can rent it, sell it, or maintain it. If you decide to lease the home,

you've safeguarded a month-to-month earnings as soon as you've located an occupant. They'll do all of the job for you, for a cost. However, that may deserve it to you. If you want a prompt cash advance, after that offering the residential or commercial property may be a better choice. You can take the cash from the sale and reinvest it however you choose.

Let's claim you bought a tax lien for $20,000. You can offer your house for $180,000, and your profit would be a cool$160,000! Tolerable for a $20,000 financial investment, eh? If you like the location the property lies in, you can absolutely keep the building and utilize it as a second home.

Given that it's your own, you additionally have the option to put the home on Airbnb when you're not there. Given that building tax obligation liens are a greater top priority than all various other liens, the home loan is wiped away if the building is gotten via tax obligation foreclosure sale. Surprisingly, a lending servicer might advance money to pay overdue real estate tax to avoid the property from entering into repossession. Naturally, the lending servicer will require the consumer to pay the innovative cash back. If the lending servicer does advancement monies to pay the overdue property taxes and you don't pay it back, the home can still be confiscated on. Keep in mind: It's constantly in your benefit to search titles for liens both legit and invalid. So Where do you discover properties with tax obligation liens on the public auction block? Government firms( the region recorder, staff, or assessor's workplace )in Texas offer cost-free lien searches to the public online, as they are public records. The auctions must be advertised in the regional paper once a week for 3 weeks before the public auction. If you're still thinking about getting tax obligation liens in Texas, then we have a few ideas that 'll serve prior to obtaining started. It would be best to bear in mind that buying a tax obligation lien certification does not mean you're the residential or commercial property's rightful owner. You generate income when the residential or commercial property proprietor pays their financial debts, yet if you win a residential property, think of it as a welcome shock. The area imposes tax liens, so you will certainly be handling the area when you get the tax obligation lien certifications. You require to familiarize yourself with the area legislations to know exactly what to expect. With that said, all areas must hold their public auctions on the very first Tuesday of the month unless it's a nationwide holiday, of course. We mentioned above that getting tax liens shouldn't be the only thing in your portfolio. It's an advantage to have, yet you do not wish to place all your eggs into one basket. Diving into the world of purchasing tax liens isn't something you need to do without mindful consideration and great deals of research study especially if you wish to make this a substantial component of your profile. Savvy capitalists can make a quite cent when they recognize the ins and outs of the method. Capitalists are usually attracted to property tax obligation liens/tax actions as a result of

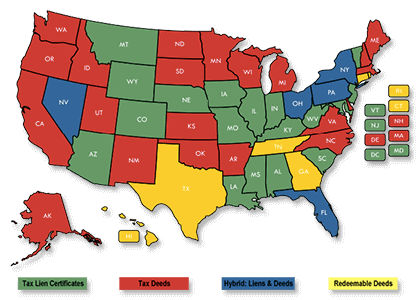

the reasonably low resources required, the prospective returns and the capacity to be associated with realty without much of the responsibility of possessing the real property. A tax obligation lien is a lien troubled the property by legislation to secure payment of tax obligations. It is enforced by the area in which the residential property islocated. A financier will certainly purchase the lien from the region for the possibility of either successful outcomes: The lien might be retrieved, implying the owner will pay the lien quantity plus rate of interest (a price that is developed by each state) to the investor. Some states do not supply tax lien investments, yet instead tax obligation acts. A tax obligation act sale is the forced sale conducted by a governmental firm of real estate for nonpayment of tax obligations. In this case, an investor has an opportunity to get a property action at price cut. Like several other properties, it's possible to buy tax liens using your individual retirement account, 401 (k ), or various other pension. Investing in tax obligation liens and deeds with self-directed IRAs are appealing financial investment approaches since they are somewhat very easy and affordable to obtain and manage. And, they have the prospective to gain a desirable return on the first financial investment. When you use retirement funds to invest, the liens and/or actions are bought by the self-directed individual retirement account and are owned by the IRA. Advanta IRA manages numerous investments in tax liens anddeeds in self-directed IRAs. While these investments have the possible to supply strong returns, as with any investment, due diligence is vital, and seeking the proper advice from experts is encouraged. Tax liens are affixed to property when proprietors fail to pay yearly home tax obligation. Governing firms market these liens at real-time or on-line public auctions. Financiers that win the bid pay the tax obligations due. The capitalist assigns and gathers a set rates of interest and charges from the property owner. The residential property owner has an established durations pay the investor to obtain the lien released from the building. In instance of default, the investor can take possession of the home and can sell it outrightanother way to gain earnings. Tax acts work a lot like tax liens when real estate tax remain in arrearswith one crucial exception: the federal government or district takes instant ownership of residential or commercial property. Tax deeds are after that marketed at auction, and the financier with the highest proposal wins ownership of that home. In 28 states, towns and regions might provide a tax obligation lien certification permitting the certification owner to claim the home until the tax obligations and any connected costs are repaid and sell it to the highest bidder. So just how can you purchase tax liens? Lienholders can bill the homeowner a rate of interest and include any kind of charge charges or costs in their settlement plan. The residential property can go into foreclosure when the property owner does not come to be current with the past due taxes and charges. In the United States , 28 states enable the government to offer tax obligation lien certifications to private investors. For more information in your area, consult your regional tax earnings workplace. Tax liens can be cost a cash amount, or the interest rate a prospective buyer agrees to accept. While homeowners have a particular amount of time to resolve up their tax bills, the investor is liable for paying when they take ownership of the tax lien certification. If the home owner pays the back tax obligations and charges, the financier redeems their cash without taking possession of the residential property. House owners that do not pay enter into foreclosure. Both tax liens and tax actions are consequences property owners need to deal with when real estate tax go unpaid. Unlike a tax obligation lien, a tax deed transfers the title of the property itself and any kind of civil liberties affixed to it to the purchaser. Some states permit the residential property owner to pay back their delinquent real estate tax and any type of costs and fines to redeem their civil liberties to the residential property. In some instances, financiers acquire the tax obligation lien certifications for as low as a few hundred bucks. Tax lien investing likewise allows charging greater prices than other forms of investing. The optimum rates of interest differs by state, however maintain in mind that your returns will be lower if you bid on the rates of interest at auction. Like any form of investing, tax obligation lien investing is not without risks. Tax obligation lien investing calls for a considerable amount of study and genuine estate knowledge from the investor to be rewarding. The residential or commercial property value requires to be significantly greater than the amount of tax due.

Latest Posts

Tax Lien Certificates List

Delinquent Tax Foreclosures

List Of Properties That Owe Back Taxes